Building on the findings from the DB investment flows survey and the Roundtable held earlier this year, the AREF Research Committee has prepared this article for AREF members:

Replacing DB investment in UK Real Estate Funds: Challenges and Opportunities

The well-documented decline in defined benefit (DB) pension schemes’ investment in UK real estate funds poses challenges for the industry. AREF is in a unique position to engage with stakeholders and, last summer, it embarked on a detailed study to better understand the extent of the issue. This was achieved through a combination of a survey of fund members and a roundtable discussion with senior real estate practitioners.1

Scale of the DB Withdrawal

The study uncovered significant apprehensions of the majority of members regarding the negative impact of declining flows on their funds. Two thirds of funds with corporate DB pension schemes as investors reported a decline in this capital base over the last three years.

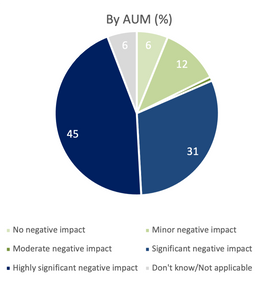

Discussants and the overwhelming majority of respondents by AUM perceived that the withdrawal of the DB pension schemes would have a significant or highly significant negative impact on their fund. However, fewer respondents by number of managers, although still a majority, anticipated the same level of negativity. This implies that the retreat of this capital source is perhaps of greater concern to the larger fund managers.

New Capital Sources

Whilst the scale of the challenge is clear, there was unsurprisingly less consensus amongst industry players as to the way forward. Discussants had less confidence than survey respondents that there would be new sources of capital to replace the DB pension scheme investment.2 This was particularly the case over the short term, but less so over the long term.

The natural replacement for this capital is seen as defined contribution (DC) pension schemes. However, participants with access to DC pension scheme clients suggest that there was currently little appetite for real estate. Views on when this money will enter the market in significant volume vary from five years to 10-15 years’ time.

An alternate source of potential capital is local government pension schemes (LGPS), however the pooling of schemes has hampered investment in recent years. It was suggested that these investors are looking for core exposure via direct rather than indirect means. This implies that many AREF funds are not within their scope. They will, however, most likely consider the fund route for specialist and overseas exposure, as this is more difficult to achieve directly.

Foreign investment may become a source of capital in the future. These would include private wealth and family offices, along with sovereign wealth funds. However, the volume of investment is not expected to be significant. Their strategies often gain exposure to real estate at the pan-regional level, or prioritise major cities and prime locations, and more exclusive relationships with platforms. These strategies are at odds with the current offering of many existing UK-focused real estate funds, which frequently have exposure to smaller markets and secondary locations.

Barriers and Challenges

A number of barriers and challenges facing new capital entering the UK funds market were highlighted.

- Education. It was felt that there is some resistance towards UK real estate from certain sources of potential investment. Major events, such as Brexit, Covid and the Liz Truss mini budget, have been detrimental to UK real estate’s reputation, and some investors with exposure have not fared well in recent years. Increased engagement with potential capital sources, particularly DC pension funds, along with education, was thought to be essential in rebuilding trust and transparency.

- Competition from other real assets. Over 20 years ago, real estate had little competition for investor capital from other sectors within private markets. However, it is no longer the default option for prospective investors seeking exposure to real assets. It was suggested that only a small minority of exiting DB pension scheme money is expected to return to real estate; the remainder could be allocated to other illiquid private markets, such as private equity, infrastructure and credit.

- Structuring. There are obstacles within current real estate fund structure offering that may be impeding investment. One example is within the Long Term Asset Fund (LTAF) structure, where there is a mismatch between liquidity and the underlying asset/vehicle. In the future, master trusts may provide a robust solution, although current fees are very low which tends to be incongruent with direct investment into real estate.

- Sustainability. There may be a perception that real estate is less sustainable compared with other real asset classes such as timber, agriculture, and infrastructure. It was noted that sustainable investment often goes no further than installing solar panels and electric charging points in buildings. There is also the significant embodied carbon issue which overshadows the asset class. It was clear that the retrofitting agenda needs government encouragement. Pricing may need to fall further to fully reflect the risks around sustainability, and the lack of clarity on associated capital expenditure costs.

Winning and losing strategies

There was also a lack of consensus as to the impact of DB capital withdrawal on the fund investment strategies themselves. The majority of respondents from the survey felt that there would not be a major impact on strategies, and they would be limited to minor changes to sector and geographical allocation. Only their development exposure and average asset lot size were likely to be modified. However, roundtable discussants disagreed with these findings, suggesting that new market entrants may have different investment objectives.

Strategies: Upside Risk

- Alternative sectors catering for mega trends, e.g. online shopping, hybrid working, ageing population.

- Sector focused funds

- Industrial, healthcare, residential should remain popular.

- Operational style products

- Segregated accounts

- Larger cities

- Large lot sizes (above £25m)

Strategies: Downside Risk

- Retail and office

- Balanced funds

- Core funds

- Secondary cities

- Smaller lot sizes (below £25m)

Guidance for Way Forward

The landscape of real estate investment is evolving and new capital sources must emerge to sustain UK real estate funds. The position of UK real estate in the current market cycle provides a major opportunity for investors. AREF is looking to engage with and educate these sources of capital. It is currently exploring two potential initiatives in this regard:

- a second roundtable event focused on DC pension schemes; and

- research material on the case for UK real estate, which will promote the asset class firstly among DC pension schemes and, subsequently, extended to cover other investor types such as overseas buyers.

Download this paper by clicking here or the image below:

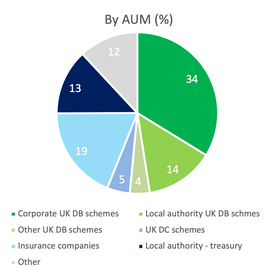

1 AUM of survey respondents was £20.4 billion, as at September 2023. A third of the respondent funds, by value, were held by corporate UK defined DB pension scheme. A further 19% of fund value was held by insurance companies and 14% retained by local authority DB pension schemes. Just 5% of the funds were owned by UK defined contribution (DC) pension schemes; roundtable held in March 2024.

2 84% of respondents by number and 72% by AUM.