On Tuesday 25th June 2024, the Merchant Taylors Hall in London played host to the AREF (The Association of Real Estate Funds) Conference, sponsored by Citco. The day was filled with engaging discussions, thought-provoking panels, and invaluable networking opportunities.

Key Highlights:

Opening Remarks:

Our new Chair, Anne Breen of abrdn, kicked off the conference by highlighting the crucial role the real estate industry can play in revitalising cities and communities. She also emphasised the UK's attractiveness to international capital, even amidst ongoing challenges.

Keynote Address:

Robert Peston delivered an impactful keynote, focusing on Labour’s commitment to planning reform. His speech set the tone for the day's discussions, sparking lively debates and deep dives into the intricacies of planning and development.

Diversity Breakfast:

The day began with a diversity breakfast moderated by Sophie Reguengo of Ogier, featuring panelists Sue Brown of Real Estate Balance, Joshua Bond of Bond Land, and Natalie Gill of PGIM. The discussion focused on social mobility and the barriers to entering the industry, underscoring the importance of diversity, equity, and inclusion (DEI) in real estate.

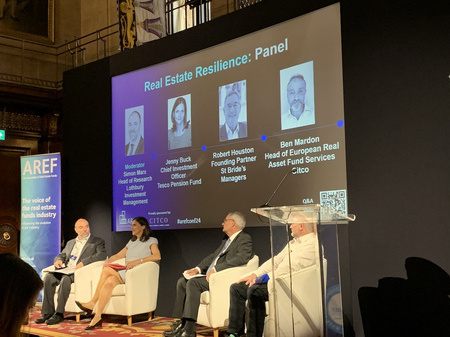

Plenary 1 - Real Estate Resilience:

Expert practitioners Jenny Buck of Tesco Pension Fund, Robert Houston of St Brides Managers, and Ben Mardon of Citco, moderated by Simon Marx of Lothbury Investment Management, discussed how real estate funds can withstand economic fluctuations both now and in the future. They emphasised that regeneration and levelling up present different risks and returns compared to the UK core market, highlighting the need for the industry to manage these risks effectively. Moreover, they stressed that both domestic and international real estate investors seek greater certainty, which could be significantly enhanced by comprehensive planning reform.

Breakout 1 - Defining & Defending Against Stranded Assets:

In a session moderated by Alexandra Notay of Thriving Investments, experts, including Phillipa Grant of Aviva Investors, Sam Carson of CBRE, and Chinyelu Oranefo of Lloyds Commercial Bank, tackled the complex issue of stranded assets. Sam Carson highlighted that achieving perfection isn't always necessary and that assets can be upgraded in stages, such as installing better windows first, with heating systems to follow later. Chinyelu Oranefo emphasized the innovative financing solutions available for housing associations, from carbon credits to patient capital. The panel delved into the definitions of stranded assets and discussed strategies to defend against related challenges, aiming to position assets for long-term sustainability and resilience.

Breakout 2 - Future Visions: Exploring the Horizons in 2040:

Our panel on the future of real estate investment, moderated by Kasia Dziewulska of CBRE, provided a forward-looking perspective on what the industry might expect a decade before reaching net zero. Expert panellists David Hedalen of Aviva Investors, Marie Hickey of Savills, Richard Pickering of Cushman & Wakfield, and Matt Richardson of Income Analytics discussed trends ranging from cold storage to data storage, predicting transformative changes in fund management. They forecast an increase in quantitative analysis, standardisation of risk and performance metrics, and significant effects from artificial intelligence, which will revolutionise how the industry operates.

During this session, we conducted two audience polls to gauge which ideas were most likely to become a reality and which ideas attendees most wanted to see happen.

Poll Results:

-

Which idea do you believe is most likely to become a reality?

- David's 'Top down sector allocation & how this will change in 2040' was the most favored to become a reality, garnering 37% of the vote.

- Richard's 'The Future of Cities' followed with 29%.

- Matthew's 'Transparency, Governance & Automation' received 25%.

- Marie's 'Physical and online retail channels to have insight parity' trailed with 8%.

-

Which idea would you most like to see happen?

- Richard's 'The Future of Cities' was the audience's top choice, with 54% hoping to see this vision realised.

- Matthew's 'Transparency, Governance & Automation' was the second most desired outcome at 38%.

- Both David's 'Top down sector allocation & how this will change in 2040' and Marie's 'Physical and online retail channels to have insight parity' received 4% each.

These results highlighted a strong interest in the future of cities and governance transparency, indicating the audience's desire for substantial changes in these areas by 2040.

Breakout 3 - Residential Real Estate:

The residential real estate session, moderated by Brenna O'Roarty and featuring Andrew Allen of Savills Investment Management, Michael Brooks of REALPAC, and William Kyle of Thriving Investments, emphasised the necessity of collaboration among government, not-for-profit organisations, and the investment industry. Drawing on successful examples from the Netherlands, the panel highlighted that such partnerships are crucial for addressing the UK’s housing crisis. The discussion underscored the distinct challenges in residential real estate, such as finding the right builders and materials, which differ from those in the commercial sector. Insights from the Canadian perspective on housing further enriched the conversation, providing a comprehensive view of potential solutions and strategies.

Break-out Session 4: Natural Capital Investment:

The natural capital session was a profound exploration into the ways the real estate industry can contribute to the enhancement, preservation, and restoration of Earth's ecosystems and biodiversity. Redington’s Celine Grace Legaspi emphasised the ongoing need for education on natural capital, noting the encouraging trend of investors beginning to ask pertinent questions. She was joined by Jessica Pilz of Fiera Real Estate and Alex Godfrey of Octopus Investments, who together explored how industry practitioners can harmonise sustainable economic development with environmental stewardship. The discussion underscored the importance of integrating natural capital considerations into investment strategies, ensuring that economic activities support environmental health and resilience. The panelists highlighted practical examples and emerging best practices that illustrate how investments in natural capital can yield both financial returns and positive ecological effects.

Plenary 3: Capital Flows:

The final plenary session included AREF's Paul Richards, who eloquently outlined the challenges and opportunities associated with the disinvestment of UK defined benefit pension funds from illiquid assets. He noted, "The last few years have been interesting. We’ve engaged with government departments who you wouldn’t think might be interested in the issue." The session, moderated by John Forbes and featuring panelists Matthew Abbott of Legal & General Investment Management and Anne Breen of abrdn, explored how changes in retirement planning strategies are affecting financial markets, investment choices, and risk management. They discussed the growing importance of defined contribution funds and how the industry can adapt to these changes.

Summer Drinks Reception:

The day concluded with a drinks reception in the picturesque Courtyard, generously sponsored by Mills & Reeve. The weather, a sunny 25°C, provided a perfect backdrop for attendees to unwind and network, reflecting on the day's insightful discussions.

The AREF Conference was a testament to the collaborative spirit within our industry and underscored the potential for real estate to drive significant societal change. We look forward to building on the insights and discussions from the conference as we navigate the future of real estate.

Stay tuned for more updates and events from AREF as we continue to explore and address the pressing issues facing our industry.

Feedback

If you were a delegate at the Conference and have not yet left your feedback, it's not too late and we'd be very grateful to receive this (link).

Photos:

A selection of photos are below, or click here to view more.

Slides:

The slides below are available to members-only, please note a log-in is required to view:

Download slides from the Main Hall

Download slides from the Drawing Room